41+ charitable remainder unitrust calculator

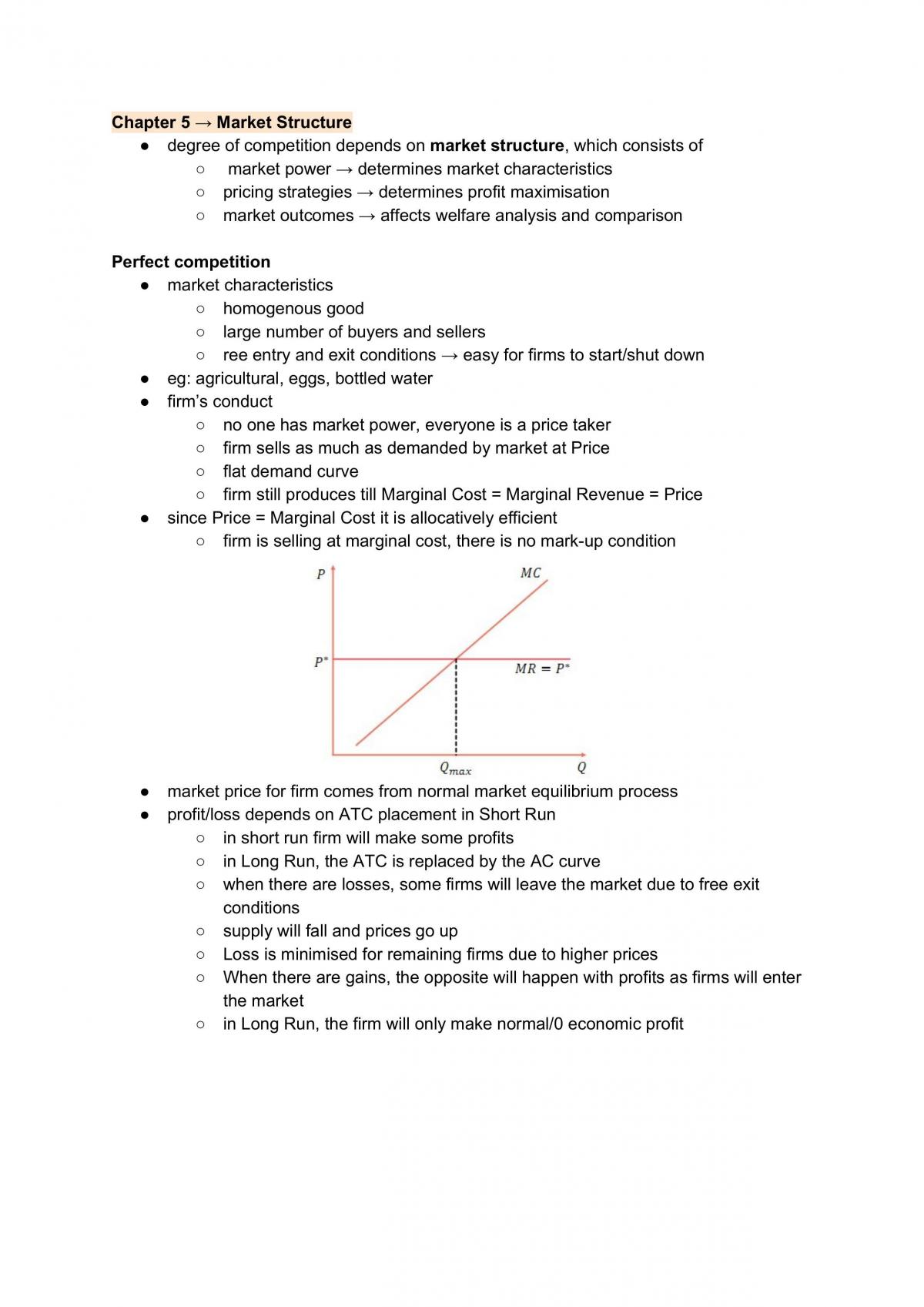

Web The remainder value to charity must be at least 10 of the funding amount. During the unitrusts term the trustee invests the unitrusts assets.

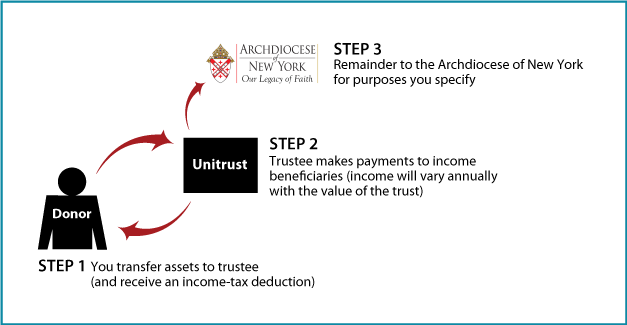

Charitable Remainder Unitrust Archdiocese Of New York

Web The most popular and flexible type of life income plan is a charitable remainder unitrust CRUT.

. Web The remainder factor multiplied by the funding amount equals the value of the charitable contribution. Fair market value of property transferred. Americans gave over 471 billion to charities in 2020 51 more than they donated in 2019.

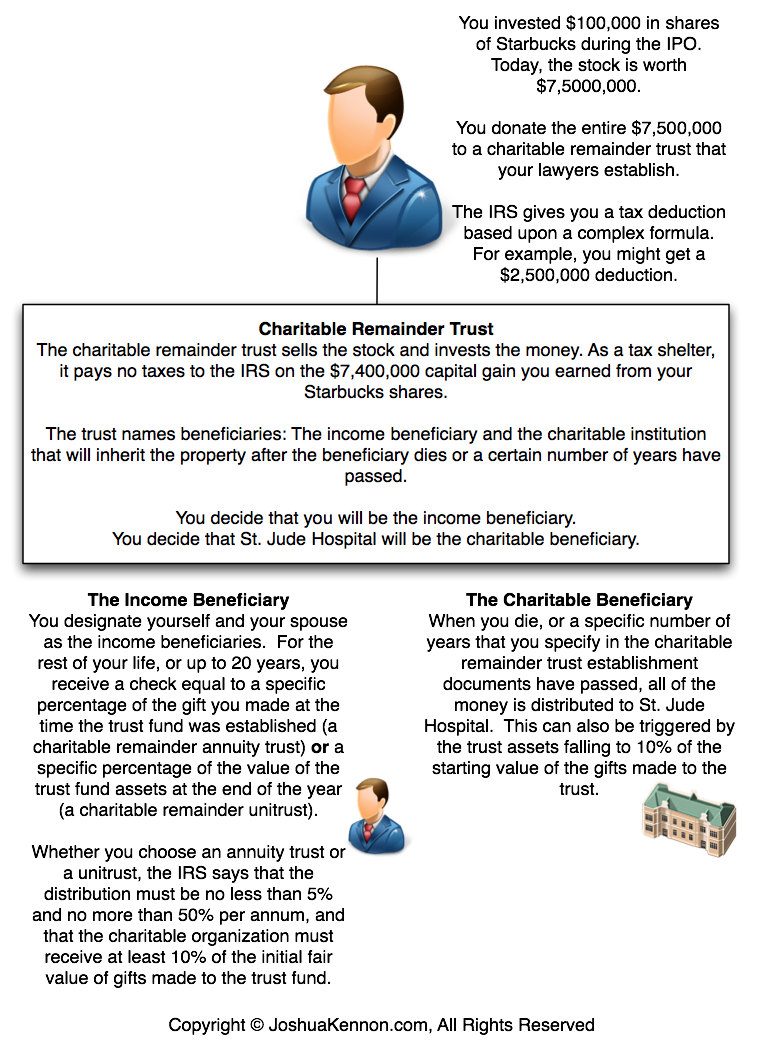

Web Upon establishing a charitable remainder unitrust you are entitled to a current income tax deduction for a portion of the value of the gift transferred to the trust which is often. Web Charitable Remainder Unitrust Calculator A great way to make a gift to the American Cancer Society receive payments that may increase over time and defer or eliminate. For example if the remainder factor for a charitable.

Web Charitable Remainder Unitrust Calculator A great way to make a gift to Oregon State University Foundation receive payments that may increase over time and defer or. Web Charitable Lead Annuity Trust link opens in new window - Reduce or possibly eliminate gift and estate taxes while receiving fixed payments. You receive an immediate.

This calculation is provided for educational purposes only. Web Charitable Remainder Unitrust - One Life Prepared for. How a CRAT Trust.

Web Home Ways to Give Plan Your Legacy Giving That Provides Income Charitable Remainder Trust Charitable Remainder Trust Gift Calculator. Web Charitable Remainder Unitrusts CRUTs can be beneficial in certain instances. Web A Net Income Charitable Remainder Unitrust NICRUT is a charitable remainder unitrust that allows for deferral of the unitrust payment as described above but does.

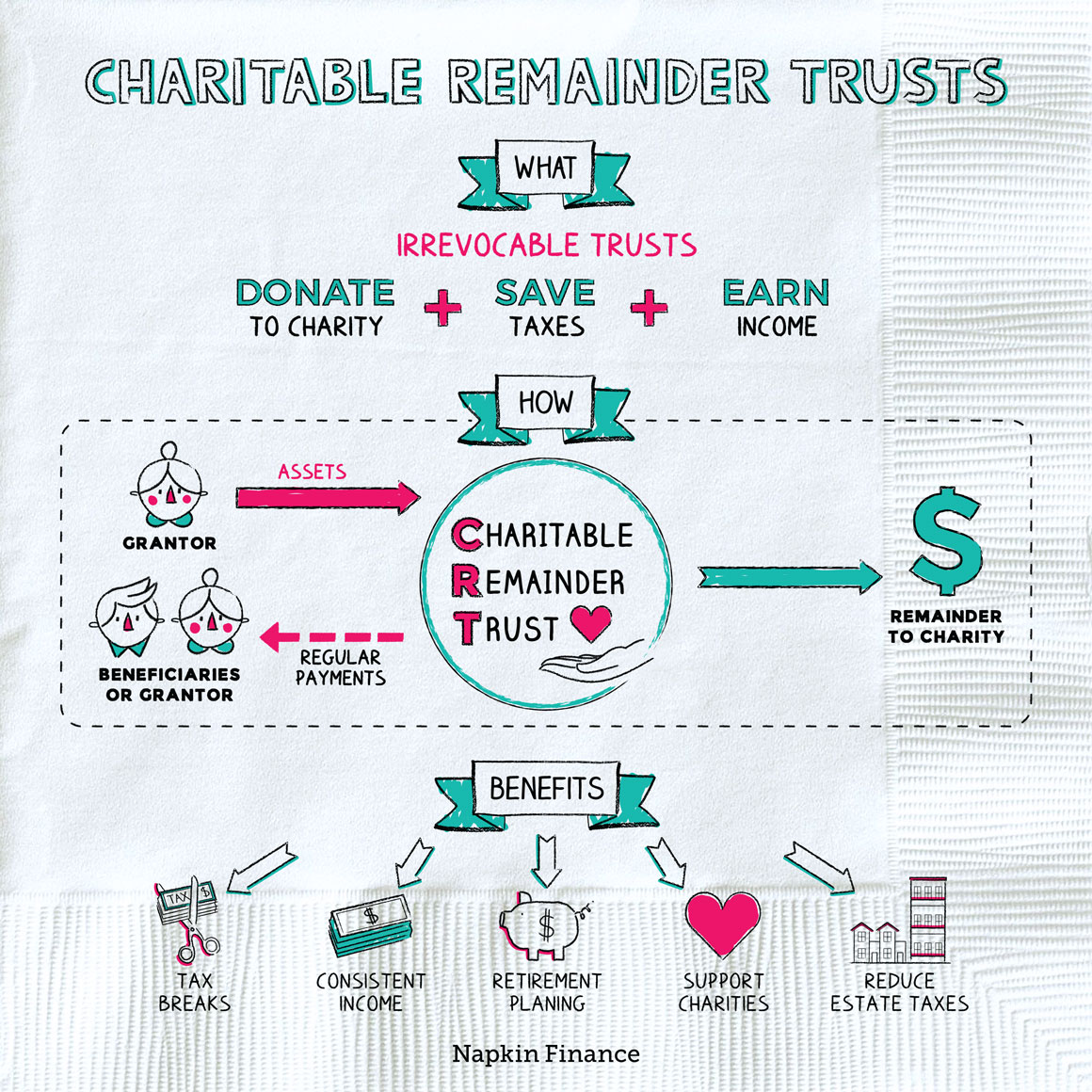

Web Charitable remainder trusts can be designated as one of two types. Web A charitable remainder unitrust is a great way to protect the lands and waters you love while receiving income for life or for a fixed number of years. Charitable remainder annuity trusts CRATs or charitable remainder unitrusts CRUTS.

Web Charitable giving is widespread in the United States. Cash securities real property or other assets are transferred into the trust. Present value of remainder interest.

Calculation of Tax Deduction for Charitable Remainder Unitrust. The payments generally must equal at. Theyre a tax-exempt Irrevocable Trust meaning they cannot be changed set up with the.

The type of assets. Local Estate Planning or Estate Settlement Representative. Web A charitable remainder unitrust CRUT pays a percentage of the value of the trust each year to noncharitable beneficiaries.

Web For the remainder unitrust the first person is the first income recipient or beneficiary of the agreement. First Age You may enter the age of the person instead of the birth date. Web Tools Resources.

Charitable Remainder Trusts For Beginners

Pdf Study Protocol Neoclear Neonatal Champagne Lumbar Punctures Every Time An Rct A Multicentre Randomised Controlled 2 2 Factorial Trial To Investigate Techniques To Increase Lumbar Puncture Success

Charitable Remainder Unitrust Crut Philanthropies

Charitable Remainder Unitrust

Charitable Remainder Unitrust Women In Distress

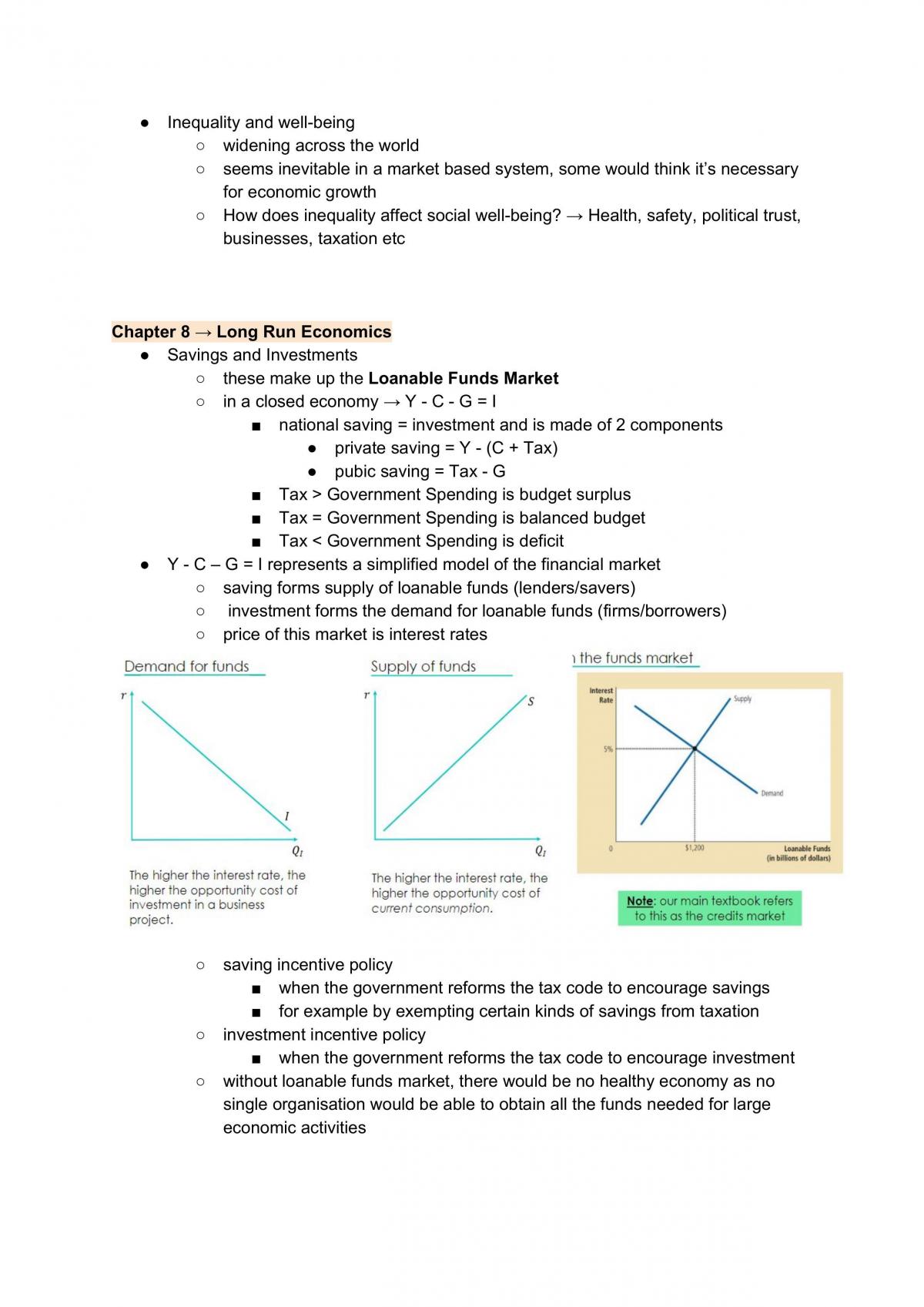

Cor2100 Economics And Society Full Notes Cor2100 Economics And Society Smu Thinkswap

Pdf New Social Policy Agendas For Europe And Asia Katherine Marshall Academia Edu

Charitable Remainder Trust Calculator Crt Calculator

Is A Charitable Remainder Trust Right For You Napkin Finance

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

Cor2100 Economics And Society Full Notes Cor2100 Economics And Society Smu Thinkswap

Pdf Evidence On The Main Factors Inhibiting Mobility And Career Development Of Researchers

41 Sample Board Resignation Letters In Pdf Ms Word Google Docs Apple Pages

Charitable Remainder Trust Calculator

Global Telemedicine And Ehealth Updates Med E Tel

Charitable Remainder Trusts Combining Lifetime Income And Philanthropy Glenmede

Charitable Remainder Trust Calculator